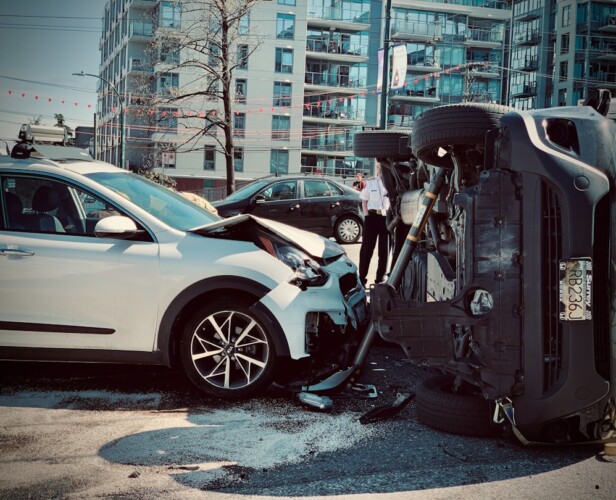

Who Pays Medical Bills In A Car Accident?

In the unfortunate event of a car accident, understanding who pays medical bills can significantly alleviate financial stress during an already challenging time. The responsibility for medical expenses often depends on various factors, including insurance coverage, fault determination, and state laws. This article explains the intricacies involved in determining who pays medical bills in a car accident.

Understanding Medical Bill Responsibility

Medical bills following a car accident are typically categorized based on the nature of the coverage and the specifics of the incident. To determine who pays these costs, consider the following:

1. Types of Insurance Coverage

There are several types of insurance that may cover medical expenses after a car accident:

- Health Insurance: Covers medical bills regardless of fault.

- Auto Insurance: Can include different components such as:

- Personal Injury Protection (PIP): Pays medical expenses regardless of fault in no-fault states.

- Liability Insurance: Pays for injuries caused by the policyholder if found at fault.

- Uninsured/Underinsured Motorist Coverage: Provides coverage if the at-fault driver has insufficient insurance.

- Workers’ Compensation: If the accident occurs while driving for work, this coverage may apply.

2. State Laws and Fault Determination

The state where the accident occurs plays a crucial role in determining who pays the medical bills. States generally follow one of two systems:

- No-Fault States: Each party’s insurance pays for their own medical expenses irrespective of fault. Examples include:

- Florida

- New York

- Michigan

- At-Fault States: The party that is determined to be at fault is responsible for paying the other party’s medical expenses through liability insurance. Examples include:

- California

- Texas

- Illinois

Who Pays for Medical Bills in Common Scenarios?

Understanding how different scenarios impact responsibility for medical bills can provide clarity in the chaos following an accident. Below are common scenarios and corresponding responsibilities:

1. If You Are Not at Fault

If you are not at fault for the accident, your medical bills may be covered by:

- Your health insurance.

- The at-fault driver’s liability insurance.

- Your own PIP coverage (if applicable).

2. If You Are at Fault

If you are found to be at fault for the accident, the implications on who pays your medical bills include:

- Your health insurance covering your medical costs.

- Your liability insurance covering the other party’s medical expenses.

3. In Cases of Shared Fault

In situations where both parties share some degree of fault, the responsibility for medical bills can become complicated:

- Insurance adjusters evaluate each person’s liability percentage.

- The payment for medical bills may be divided according to the percentage of fault.

What to Do After an Accident

After a car accident, taking the right steps can help streamline the process of getting your medical bills paid. Follow these actionable steps:

1. Seek Medical Attention

Your health should be the first priority. Even if you feel fine, many injuries are not immediately apparent.

2. Document Everything

Collect and maintain records of:

- Police reports.

- Medical records and bills.

- Witness statements.

- Insurance information from all parties involved.

3. Notify Your Insurance Company

Inform your insurance provider about the accident as soon as possible. Provide them with all relevant details to assist in the claims process.

4. File Claims Promptly

File claims with both your health insurance and auto insurance. Delays can result in complications and potentially deny claims for coverage.

Working with Medical Providers

Communicating with healthcare providers about your accident is crucial. Here are ways to manage your medical bills effectively:

1. Discuss Payment Plans

Many providers offer payment plans for patients recovering from accidents. This approach can ease the immediate financial burden.

2. Use a Letter of Protection

A letter of protection is an agreement between you and your medical provider that allows treatment without upfront payment until the case is resolved.

Common Questions About Medical Bills in Car Accidents

Here are some frequently asked questions related to medical bill responsibilities:

1. Can I sue the other driver for my medical bills?

If the other driver was at fault, and you have sufficient evidence, you can pursue a personal injury claim to recover medical expenses.

2. What happens if the at-fault driver is uninsured?

If the at-fault driver has no insurance, you may use your uninsured motorist coverage (if you have it) or pursue legal action against the driver directly.

3. How long do I have to file a claim?

The statute of limitations for filing a personal injury claim varies by state, typically ranging from 1 to 6 years. It is essential to review your state’s specific laws.

Conclusion

Determining who pays medical bills in a car accident involves understanding various factors, including insurance types, state laws, and fault. Always seek professional advice when navigating the complexities of accident-related medical expenses. Taking decisive action post-accident will ensure that you receive the necessary care while managing the associated costs effectively.